Are you looking for investment, pitch your idea with us!

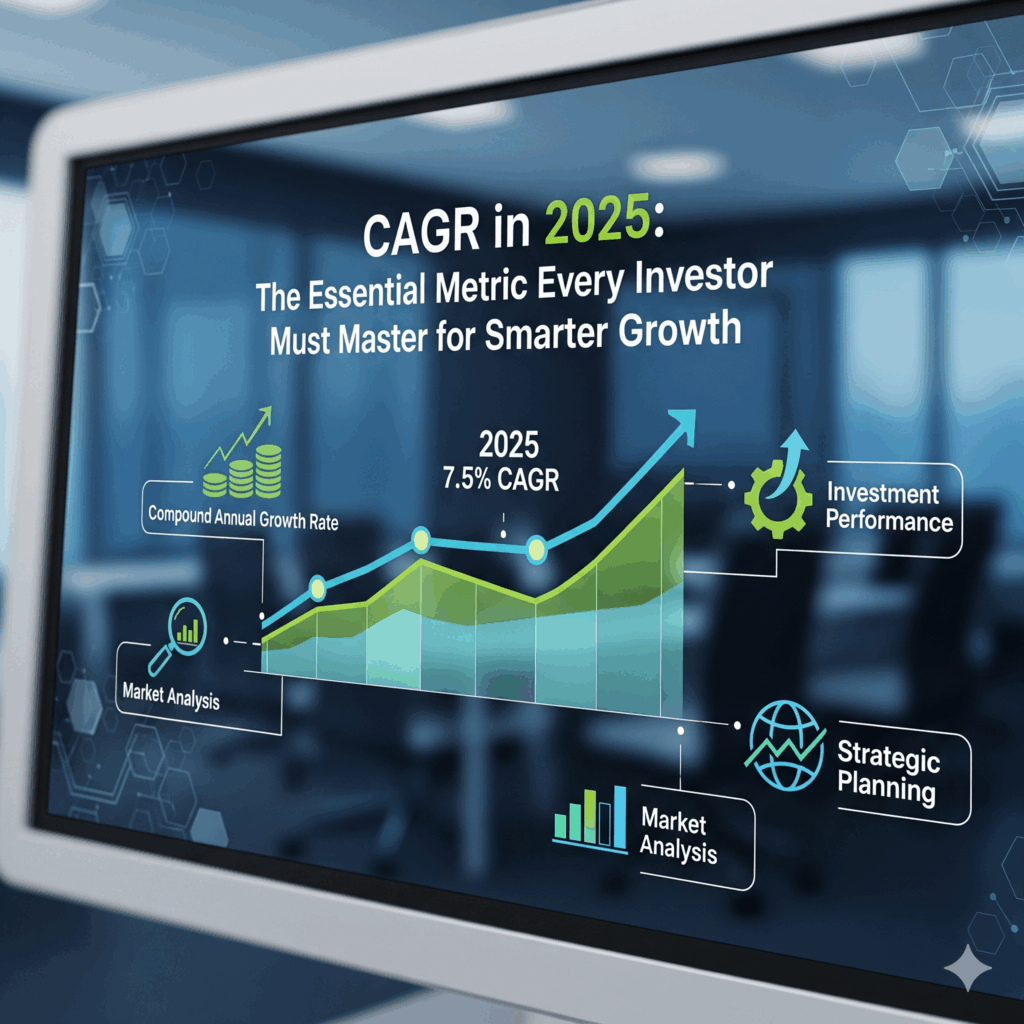

In the fast-paced world of business and investing, one metric stands out for its ability to cut through the noise: CAGR, or Compound Annual Growth Rate. As we enter 2025, with financial markets more volatile than ever and startups scaling globally, CAGR remains an essential tool for investors and entrepreneurs who want to measure sustainable long-term growth.

What is CAGR?

At its core, CAGR tells you the average rate at which an investment or business grows each year over a period of time. Instead of focusing on ups and downs from one year to the next, it smooths everything out and shows the real growth path.

For example, if a startup’s revenue grew from $1 million in 2020 to $2 million in 2025, CAGR gives you the average annual growth rate over those five years. It doesn’t get distracted by short-term losses or unusually high gains—it focuses on the big picture.

That’s why investors, analysts, and business leaders rely on CAGR when making strategic decisions.

Why CAGR Matters in 2025?

In today’s environment, investors deal with fluctuating stock markets, new technologies like AI, and rapid globalization. Year-to-year data can be misleading. CAGR provides a clearer and more reliable way to measure progress.

Here’s why CAGR is more important than ever in 2025:

- Clarity in Volatile Markets – It cuts through unpredictable swings and shows long-term growth.

- Better Comparisons – CAGR helps investors evaluate different assets, like stocks, mutual funds, or real estate.

- Strategic Planning – Businesses use CAGR to forecast revenue and expansion.

- Investor Confidence – A clear CAGR figure builds trust among venture capitalists and shareholders.

CAGR vs. Other Growth Metrics

CAGR is different from other growth measures:

- Simple Growth Rate only shows total growth over time but doesn’t consider the yearly pace.

- Average Returns can be misleading because they don’t account for compounding or volatility.

- CAGR is unique because it gives the true annualized growth rate, making it more reliable for long-term planning.

Applications of CAGR in 2025

CAGR is not limited to finance. It’s applied across multiple fields:

1. Stock Market Investments

Investors use CAGR to see how consistently a company has performed over five, ten, or more years.

2. Startup Growth

Entrepreneurs and venture capitalists use CAGR to measure revenue growth, user adoption, and market expansion.

3. Mutual Funds and ETFs

CAGR shows how well funds have grown compared to competitors.

4. Real Estate

From property prices to rental income, CAGR is used to measure steady returns.

5. Business Forecasting

Companies rely on CAGR to set realistic sales targets and compare their performance with industry averages.

Real-World Examples of CAGR

- Tech Companies – A company like Apple or Amazon may face ups and downs each year, but CAGR reveals their consistent growth trend over decades.

- Green Energy Startups – With rising demand for renewable energy, CAGR is used to measure how quickly these companies are scaling.

- Global Markets – Reports often use CAGR when predicting industry growth, like “India’s digital payments sector will grow at a CAGR of 18% from 2025 to 2030.”

Advantages of Using CAGR

✅ Simple and easy to understand

✅ Works across different industries

✅ Helps compare multiple investments or businesses

✅ Smooths out yearly volatility

✅ Builds long-term confidence in decisions

How to Use CAGR for Smarter Decisions

Here are some ways investors and businesses are applying CAGR in 2025:

- Compare Investments – When choosing between two stocks or funds, CAGR reveals which one has shown more consistent growth.

- Set Financial Goals – CAGR helps individuals and companies plan realistic targets.

- Evaluate Risk vs. Reward – Pair CAGR with risk metrics for balanced decisions.

- Track Portfolio Performance – Regularly calculating CAGR keeps investors aligned with their long-term goals.

CAGR and the Future of Investing

In 2025, financial technology platforms and AI-driven dashboards make CAGR easier to calculate and analyze than ever before. Whether you are tracking crypto portfolios, green energy investments, or startup valuations, CAGR is often the first metric displayed.

As markets get more complex, CAGR remains a simple yet powerful lens to evaluate performance. It is trusted globally by analysts, fund managers, and entrepreneurs.

Conclusion

In 2025, CAGR is the essential metric every investor must master. It simplifies the complexity of financial data, offers clarity in uncertain times, and provides a true picture of growth.

Whether you’re an investor evaluating stocks, an entrepreneur scaling a startup, or an individual planning your financial future, CAGR is your trusted compass for smarter growth.

Master CAGR, and you’ll unlock one of the most valuable tools in business and investing.